Are you Purchasing, Refinancing or Buying & Selling?

FHA

VA

USDA

Conventional

First Time Buyer / Down Payment Assistance

Specializing in Denver & Colorado Springs Markets

Rate and Term (lower payment)

Cash-out

Debt Consolidation

Specializing in Denver & Colorado Springs Markets

Seamless Experience

Minimize Stress

Maximize Profit

OUR TEAM

Mike O'Brien NMLS # 1340152

Matthew Wentz NMLS #1852397

Zach Belloni NMLS #2568001

Testimonials

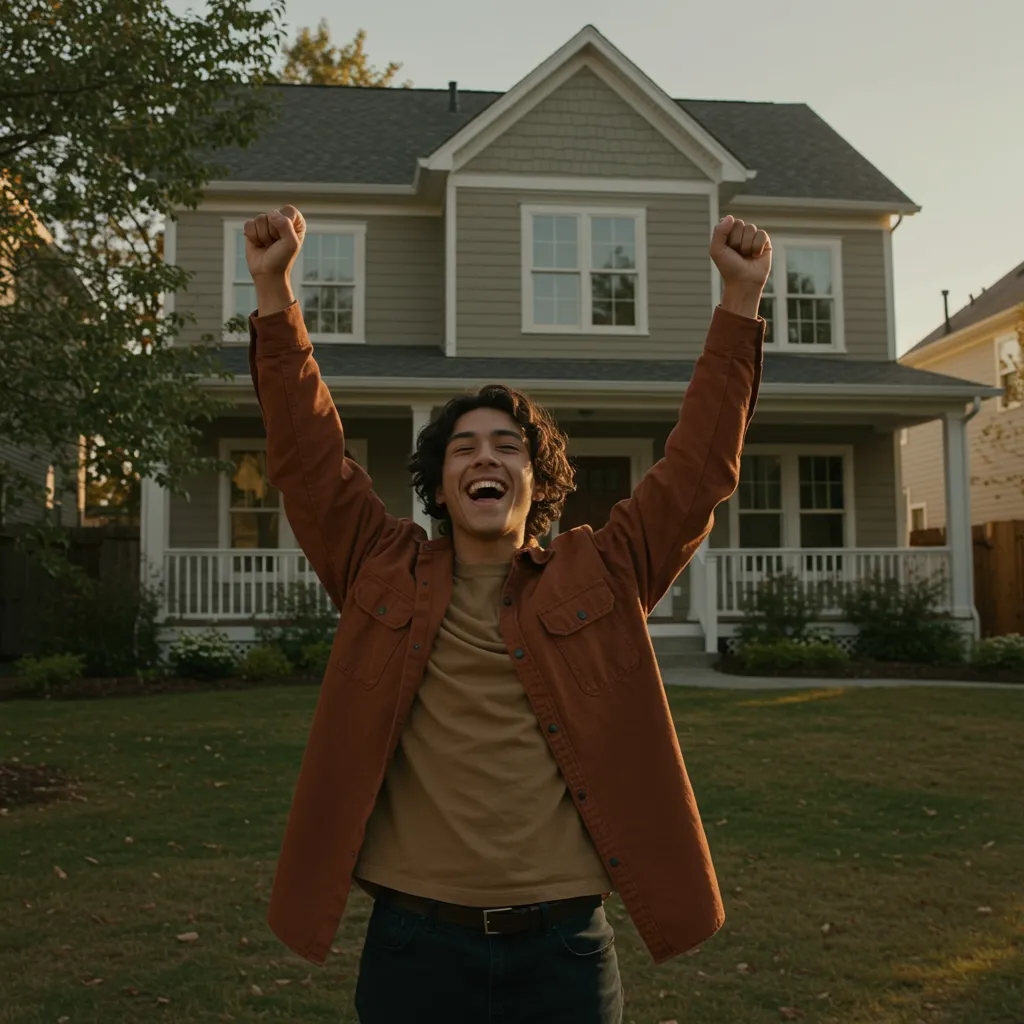

This was my fiancé and I first time buying a home and I connected with Zach from speak straight mortgage and from day 1 he made the whole home buying experience very comfortable and very easy. His father in law Mike was also there every step of the way along with Matt! Those 3 Gentlemen made the whole home buying process so smooth for us that alls we had to do was go look at homes and put in an offer and the guys at speak straight took care of everything else! Thank you Zach, Mike, and Matt for helping us purchase our first home! Will definitely recommend anyone I know looking for their dream home!!

Michael

I can't say enough good things about Speak Straight Mortgage, especially Matthew Wentz. I’ve been trying to buy a home for so many years, and at times I felt completely hopeless. But Matthew changed everything. Not only did he explain how the system works—he actually sat down with me and showed me step by step. He made sure I understood every part of the process and never made me feel rushed or overwhelmed. Thanks to his patience, knowledge, and genuine care, I finally feel like I was given a real chance. I’m beyond grateful for his help. If you're looking for someone who truly goes above and beyond, talk to Matthew!.

Hassan

Mike is a true pro! We just completed another transaction together and there were SMILES all around the closing table! Mike and his team are trustworthy, reliable, honest, hard working, super knowledgeable on all facets of the lending business. I'm looking forward to our next transaction together.

Bill

Rate Update

8/19/2025 Mortgage Rates

Current Mortgage Purchase and Refinance rates for 8/19/2025 ...more

Mortgage Rates

August 19, 2025•1 min read

Learning Center

Closing Cost Explainer

Learn how to estimate your true closing costs with this hands-on video lesson from Speak Straight Mortgage. Using a downloadable workbook, you'll break down lender fees, insurance, prepaid costs, and ... ...more

What Will My Payments Be?

May 17, 2025•2 min read

What Types of Loans Are Available?

Ever find yourself puzzled by the different home loan options? FHA, VA, USDA, Conventional... What does it all mean, and which one is right for you? ...more

What Will My Payments Be?

May 16, 2025•1 min read

Calculators & Tools

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

Company NMLS # 2426226

Equal Housing Opportunity

FOLLOW US

COMPANY

LEGAL

Copyright 2026. Speak Straight Mortgage - EmpowerElite. All Rights Reserved.